According to the IBM Retail Index, COVID-19 accelerated the shift to e-commerce by about 5 years. The global pandemic transformed many aspects of consumers’ lives. But few are as pronounced as how we shop. Within 32 months, COVID-19 went from pouring jet fuel on e-commerce to stoking pent-up demand for brick-and-mortar shopping, resulting in a new and dominant consumer behavior: the omnichannel shopper.

SCS polled 750 US consumers to uncover the shifts in the buying journey and discovered a snapshot of today’s omnichannel customer. What emerges is a portrait of shoppers who lean heavily into eCommerce and technology across the shopping journey, even when making their purchases at a brick-and-mortar store. Over the past three years, the share of overall eCommerce sales has increased, brands have invested more rapidly into customer experience technology, and consumers are continuing to shift their online time to mobile screens.

Many consumers have become deeply entrenched in Amazon, with 73% of polled consumers living in households that have an Amazon Prime membership, about 8% using the accounts of a friend or family member, and 11% more planning on signing up. There is a strong preference for Prime Delivery; price and product being equal, 55% would rather have a purchase delivered tomorrow than go to the store to buy it today.

Trips to the store have turned many traditional shoppers into Brick & Mobile buyers, with 40% looking for better deals and products from their phone while browsing the aisles of a physical store.

The majority of consumers are fully entrenched in both eCommerce and brick-and-mortar retail shopping, and their shopping habits are now threaded together:

- 68% of people estimate that they spend 50% or more of their shopping online

- 54.3% have made their purchase decision online, then purchased at retail

- 40% spend time browsing brand websites for better prices while standing in a brick-and-mortar aisle

- 60.5% have used Buy Online PIck-up In-Store

- 33.9% have returned items to the store they purchased online

Their verbatim responses to the survey continues the picture:

- “I checked some physical stores before deciding to purchase online”

- “I looked at the star ratings, read reviews, and watched YouTube videos on the product (before purchasing)”

- “In Walmart and Kroger I use my iPhone to locate products and check prices.”

- “Went to a store, but decided to buy it online because it was cheaper”

- “Go to multiple websites to compare prices and THEN decide where to get it.”

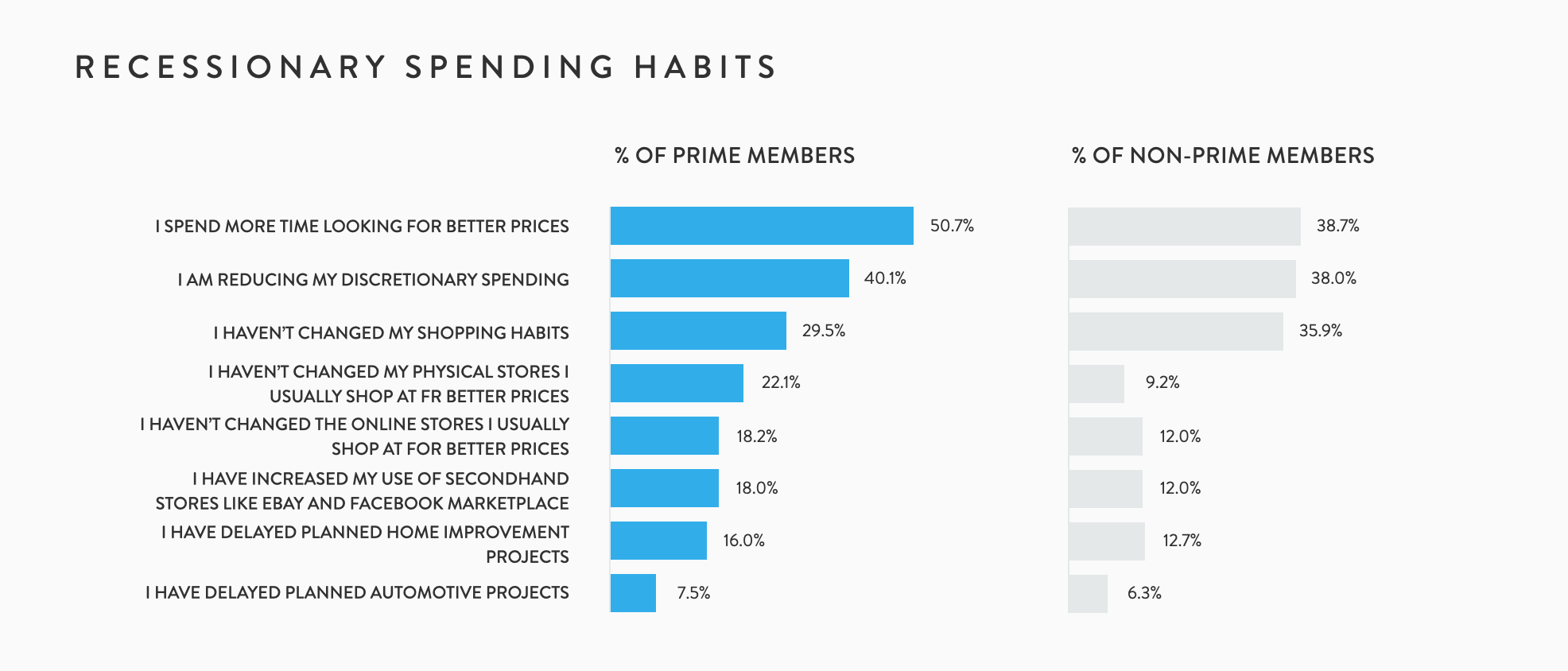

Price sensitivity is high. While recession concerns have a slight impact on consumers’ planned purchases, cost is clearly reflected in a consistent ranking of price as the primary factor across the board for purchase decisions. Among households polled with over $100k HHI, 45% had shopped at a bargain “dollar store” in the past year.

These insights, along with a roadmap for brands to drive revenue by acting on them, are included in the whitepaper Omnichannel Overdrive.